glendale az vehicle sales tax

Water Sewer Trash Bill. The December 2020 total local sales tax rate was also 9200.

New And Used Pontiac For Sale Carpages Ca

Sales Tax Office in Glendale AZ.

. Glendale AZ Sales Tax Rate. GE stands for City of Glendale. E All taxpayers required to file and pay taxes under Section 211-445 will obtain one license per person for all locations and units of real residential property rented within the City of Glendale regardless of the provisions of Sec.

17 lower than the maximum sales tax in AZ. Glendale Details Glendale AZ is in Maricopa County. You can find more tax rates and allowances for Glendale and Arizona in the 2022 Arizona Tax Tables.

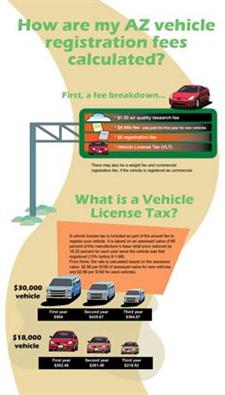

Arizona collects a 66 state sales tax rate on the purchase of all vehicles. Apply to Tax Analyst Tax Preparer Senior Accountant and more. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

Register with the State of Arizona. ARIZONA DEPARTMENT OF REVENUE. 2020 rates included for use while preparing your income tax deduction.

The current total local sales tax rate in Glendale AZ is 9200. Did South Dakota v. 42-5061 A 28 a link is external provides an exemption from state TPT and county excise tax for sales of motor vehicles to nonresidents from states that do not provide a credit for taxes paid in Arizona.

There is no applicable special tax. Sales Tax Rate Chart. For vehicles that are being rented or leased see see taxation of leases and rentals.

The Vehicle Use Tax Calculator developed and implemented by the Arizona Department of Revenue ADOR is a tool that provides that convenience with a one-stop shop experience. County tax can be as high as 07 and city tax can be up to 25. The County sales tax rate is.

Real property tax on median home. The minimum combined 2022 sales tax rate for Glendale Arizona is. Residential Rental City Tax Rate effective 1112007 22.

Cities and towns share in a portion of the collection total. The Arizona sales tax rate is currently. For previous rates and fees contact Customer Service at 623 930-3190.

Surprise Sales Tax in Glendale AZ. Rates include state county and city taxes. Arizona has a 56 statewide sales tax rate but also has 80 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2403 on top of the state tax.

Name A - Z Sponsored Links. Expires December 31 2014. This Arizona TPT exemption prevents the nonresident purchaser from having to pay tax in both states.

You can print a 92 sales tax table here. Taxes reported for the City of Glendale must be on a separate line of the State return with a City Code of GE. Object moved to here.

For tax rates in other cities see Arizona sales taxes by city and county. Glendale City Hall 5850 W. The December 2020 total local sales tax rate was also 10250.

State Transaction Privilege Tax Sales Tax The current rate of the State sales tax is six and six-tenths percent 66. However the total tax may be higher depending on the county and city the vehicle is purchased in. Tax Paid Out of State.

For more information on vehicle use tax andor how to use the calculator click on the links below. The business code for residential rental on the State return is 045. Government Offices Federal Government Tax Return Preparation-Business 800 829-1040.

Marana AZ Sales Tax Rate. 31 rows The latest sales tax rates for cities in Arizona AZ state. City Hall Offices are open Monday - Friday from 730 am.

Glendale in Arizona has a tax rate of 92 for 2022 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in Glendale totaling 36. Goodyear AZ Sales Tax Rate. Sales Tax State Local Sales Tax on Food.

See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Glendale AZ. Lake Havasu City AZ Sales Tax Rate. The voter-approved 1 increase passed in 2010 does not translate into additional state-shared revenue and will be repealed at the end of three years.

Name A - Z Sponsored Links. The Glendale sales tax rate is. Wayfair Inc affect Arizona.

Internal Revenue Service - Federal Tax Information. What is the sales tax rate in Glendale Arizona. Price of Accessories Additions Trade-In Value.

Consignment Service Furniture Stores Used Furniture 3 Website 623 251-5281. This is the total of state county and city sales tax rates. The current total local sales tax rate in Glendale CA is 10250.

The 92 sales tax rate in Glendale consists of 56 Arizona state sales tax 07 Maricopa County sales tax and 29 Glendale tax. This means that depending on your location within Arizona the total tax you pay can be significantly higher than the 56 state sales tax.

Used Vehicles For Sale At Arrowhead Bmw In Glendale Az Arrowhead Bmw

Gw Auto Performance Home Facebook

Empi Imp Dune Buggy Buggy Vw Dune Buggy

What Happens When Insurance Totals Your Car

Your Top Vehicle Registration Questions And The Answers Adot

Mach E December 2021 Sales Production Numbers 2 349 Sold 5 405 Produced Macheforum Ford Mustang Mach E Forum News Owners Discussions

Used Certified Loaner Vehicles For Sale In Peoria Az Liberty Buick

Used 2007 Ford Mustang For Sale Near Me Edmunds

How Electric Vehicles And Autonomous Vehicles Are Destroying Our Roads And Why Cities And States Will Have The Solution Johns Hopkins Center For Government Excellence

New And Used Jeep For Sale In Peterborough On Carpages Ca

Vehicles For Sale In Peoria Az Liberty Buick

New Used Honda Cars For Sale Phoenix Honda Auto Service Repair Bell Honda 49 95 Just To Look And Diagnos Honda Cars For Sale Honda Cars Auto Service